The Miami housing market is a key player in the real estate industry because it is an international city and gateway to Latin America. Despite the city’s economic importance and booming population growth, recent data indicate a shift toward a buyer’s market.

With higher housing inventory and low homebuilder confidence, Miami’s housing market is in a state of flux. However, it is important to note that this doesn’t necessarily reflect the overall sentiment of those on the ground in the city.

In this article, we will delve into the current state of the Miami housing market, exploring the factors that are driving these trends and what we can expect in the future.

Using data from the U.S. News Housing Market Index, we will provide a comprehensive overview of the market, including recent trends, current conditions, and projections for mid-2023.

Whether you are a prospective buyer, seller, or simply interested in the real estate industry, this article will provide valuable insights into the Miami housing market.

Miami Housing Market Overview

The Miami housing market in 2022 and 2023 is discussed in this overview, including predictions, trends, foreclosure statistics, and median house prices.

Miami is a highly sought-after location for both commercial and residential purposes, making the real estate market one of the hottest in the country.

With the lasting impact of the pandemic and the Federal Reserve’s actions, inventory has become a commodity. This article explores whether investing in Miami real estate is a good idea and offers potential exit strategies for investors to consider.

Miami’s real estate market has been on a steady rise, with the median home value reaching $556,582 in 2022. The market has been very active, with 779 new listings and 11,901 active listings, indicating a growing interest in the area.

The median list price has increased by 24.9% year over year, and the 1-year appreciation rate is 27.4%. Looking ahead, the median home value is predicted to increase by 2.0%.

Despite the growth in inventory, the number of homes sold decreased by 26.6% year over year, with only 566.8 homes sold. However, the median days on the market increased only slightly by 0.9 years over a year to 54 days.

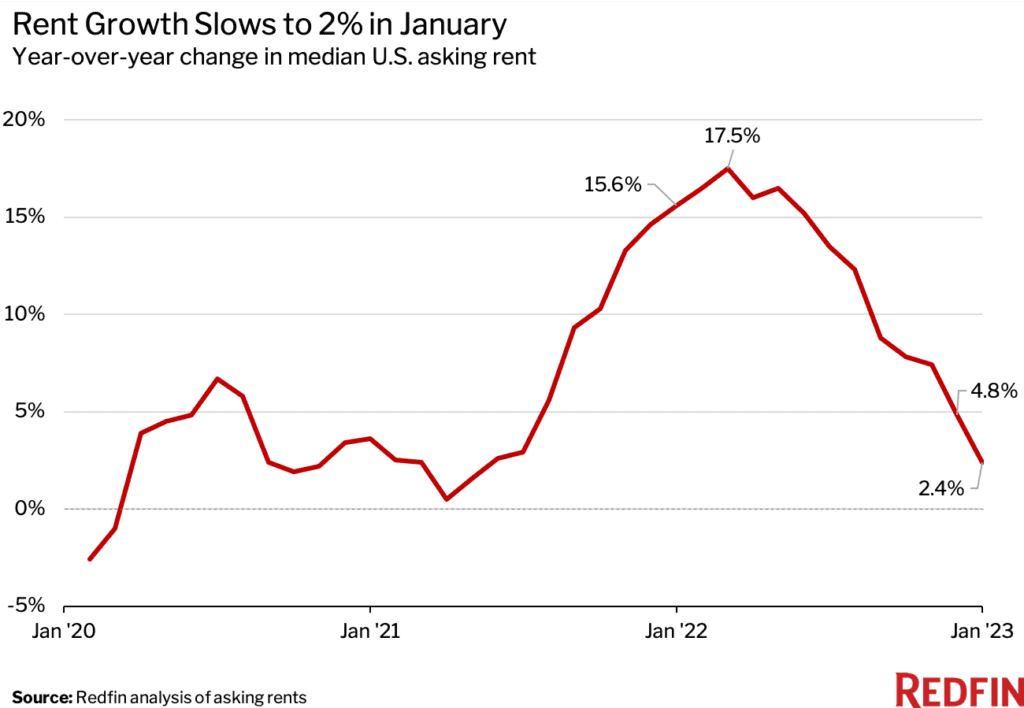

The rental market has also seen a significant increase, with a 6.3% year-over-year increase in median rent for 1- and 2-bedroom units, now standing at $2,050. The price-to-rent ratio is 22.62.

The unemployment rate in Miami-Dade County is low, with the Bureau of Labor Statistics estimating it to be 2.3%. This low rate indicates that there is a stable economic environment, making it a desirable place to live and work.

Miami-Dade County has a population of 2,662,777, according to the latest estimate by the U.S. Census Bureau. The county’s median household income is $53,975, indicating that it is affordable, especially considering the high median home value.

Miami has also experienced a total of 3,327 foreclosures, which is something to keep in mind when considering buying a property. However, the Miami real estate market remains strong and active, with a growing interest in the area.

The weeks of supply have increased by 8.1 years over year, with a current rate of 25.2 weeks of supply. This increase is a positive sign for buyers as it suggests that there is a larger selection of homes available on the market.

Average Home Prices In Miami 2023

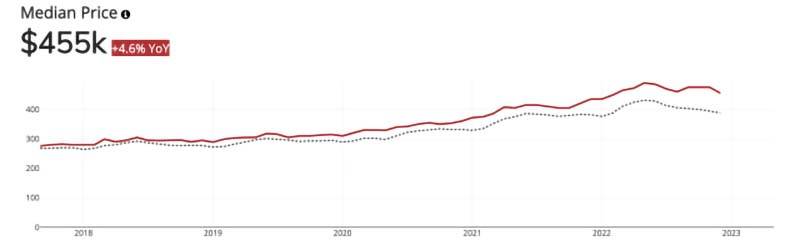

According to Redfin, the Miami housing market saw a 4.6% increase in median home prices in December, reaching $455,000. While homes are selling close to market price, the lack of multiple-offer situations is causing sellers to price more reasonably.

The rental market is also seeing significant gains, with median rent in the Miami area reaching $2,871, up over 32% from December 2021.

The growing population of Miami contributes to the rising sale and rent prices, with the total number of households reaching 2.31 million, making it the seventh-most populous metro area in the U.S.

However, the high cost of construction and increased interest rates are potential obstacles to the affordability of homes in the Miami area. The average 30-year fixed-rate mortgage interest rate was 6.36% in December, significantly higher than the previous year.

Despite potential volatility, median home prices in Miami have seen a steady rise since 2018, and the market is showing no signs of slowing down.

According to statistics from Zillow, the median home price currently sits at $530,900, up 16% since 2022. These trends indicate an increase in demand for housing in the region, making it a lucrative investment opportunity.

It’s important to note that average house prices in Miami vary depending on location, with areas such as Brickell or South Beach having higher averages due to their proximity to amenities and attractions like beaches, parks, and shopping districts.

Neighborhoods like Westchester or Kendall are ideal for those looking for lower-priced options due to their affordability compared to other areas within the metropolitan area.

Buyers should consider current pricing and future developments when making an investment decision.

Predictions indicate that median home prices and demand are expected to increase steadily over time, making now a potentially opportune moment to take advantage of these conditions before they become more competitive.

With all factors considered, purchasing property in Miami could present itself as a highly lucrative opportunity moving forward.

Current Housing Market Trends In Miami

Based on the available web search results, the current housing market trends in Miami in February 2023 indicate an increase in home prices by 6.2% compared to the previous year, with a median selling price of $542,000.

However, the number of homes sold in February 2023 decreased by 44% compared to the same period last year, with only 529 homes sold. On average, homes in Miami are selling after 77 days on the market, an increase from 65 days in the previous year.

In January 2023, foreclosures in Miami were up 36% compared to the previous year and up 2% between December 2022 and January 2023.

However, it’s important to note that the 2023 housing market differs from the 2008 housing crisis as many homeowners have equity and are not overleveraged.

The Miami-Dade County housing market trends for February 2023 indicate an increase in the median sale price to $475,000, which is a 17.3% increase compared to the previous year.

The average sale price per square foot is $343, which is a 16.7% increase compared to the previous year.

The number of homes sold in February 2023 decreased by 30.3% compared to the same period last year. The average number of days a home spends on the market has decreased to 51 days, which is a 4-day decrease compared to the previous year.

Factors Affecting The Miami Real Estate Market

As the Miami real estate market continues to experience healthy growth, potential buyers may be interested in learning how they can get the best deals when purchasing a property.

To this end, it is essential for individuals to conduct their own research and analysis into recent local trends so that they can make informed decisions on what type of home or investment will suit them best.

Understanding current pricing dynamics within different neighborhoods throughout South Florida is key, too, as costs can vary significantly depending upon location–particularly between downtown areas like Brickell Avenue or Coconut Grove and other more suburban parts of town.

Furthermore, prospective purchasers should also compare mortgage rates offered by various lenders in order to secure good financing options with reasonable terms and conditions attached.

Additionally, having an experienced realtor who keeps up-to-date with the latest listings in the area can help buyers find out about newly available properties before anyone else does, which could result in great savings if purchases are made quickly.

Overall, those looking to purchase a home or invest in real estate in Miami must be savvy enough to understand underlying market forces while also keeping an eye out for any potential bargains that come along from time to time.

By taking advantage of these tips and making smart choices based on one’s individual needs, it is possible for investors to benefit greatly from participating in this exciting housing sector.

Here is a list of factors affecting the Miami real estate market based on the provided web search results:

- Interest rates and borrowing costs: Lower borrowing costs can lead to increased demand for real estate, while higher interest rates can result in decreased demand.

- Home values: Historically, high home values can attract investors, but a sudden drop in value could result in decreased demand.

- Vacancy rates: A low risk of vacancies can make real estate investment more attractive, as it can result in a more stable income stream.

- Price-to-rent ratio: The demand for rental properties is expected to increase due to Miami’s 22.62 price-to-rent ratio.

- International demand: Miami’s real estate market is heavily influenced by international demand, with countries like Colombia, China, and Venezuela among the top 10 countries searching for real estate in Miami.

- Economic conditions: Changes in the local and national economy can have a significant impact on the Miami real estate market, as economic growth can lead to increased demand, while a recession can result in decreased demand.

The Difficult Environment For Homebuyers

The current real estate market in many areas, including Miami, can be a difficult environment for homebuyers. One of the biggest challenges facing buyers is the lack of available inventory.

The pandemic caused a surge in demand for homes, and many homeowners opted to stay put, resulting in fewer homes on the market. This has led to bidding wars and increased competition among buyers, making it challenging to find and secure a desirable property.

Another challenge for homebuyers is rising home prices. In Miami, for example, the median price of single-family homes has increased for 133 consecutive months [2], and this trend is expected to continue in 2023.

The combination of high demand and limited supply has driven up prices, making it difficult for many buyers to afford a home in their desired location.

Financing can also be a challenge for homebuyers in the current market. While mortgage rates have remained relatively low, lenders have tightened their lending standards, making it more difficult for some buyers to qualify for a mortgage.

Additionally, buyers may face competition from cash buyers who are able to make a more attractive offer due to not needing financing.

Finally, the current real estate market can be challenging for buyers due to the fast pace of transactions. With many buyers vying for a limited number of properties, buyers need to act quickly to make an offer and secure a home.

This can be stressful and overwhelming for some buyers, especially those who are new to the process. Despite these challenges, there are steps that homebuyers can take to increase their chances of success in the current market.

Working with an experienced real estate agent can be helpful in navigating the market and identifying potential properties.

Buyers should also be prepared to act quickly when a desirable property becomes available and consider getting pre-approved for a mortgage to demonstrate their financial readiness to buy.

Tips For Buying A Home In Miami

As the Miami real estate market continues to experience healthy growth, potential buyers may be interested in learning how they can get the best deals when purchasing a property.

To this end, it is essential for individuals to conduct their own research and analysis into recent local trends so that they can make informed decisions on what type of home or investment will suit them best.

Understanding current pricing dynamics within different neighborhoods throughout South Florida is key, too, as costs can vary significantly depending upon location–particularly between downtown areas like Brickell Avenue or Coconut Grove and other more suburban parts of town.

Furthermore, prospective purchasers should also compare mortgage rates offered by various lenders in order to secure good financing options with reasonable terms and conditions attached.

Furthermore, having an experienced realtor who keeps up-to-date with the latest listings in the area can help buyers find out about newly available properties before anyone else does, which could result in great savings if purchases are made quickly.

Overall, those looking to purchase a home or invest in real estate in Miami must be savvy enough to understand underlying market forces while also keeping an eye out for any potential bargains that come along from time to time.

By taking advantage of these tips and making smart choices based on one’s individual needs, it is possible for investors to benefit greatly from participating in this exciting housing sector.

How To Find The Best Deals In The Miami Real Estate Market

The Miami real estate market is constantly changing, requiring individuals to stay up-to-date on the latest trends in order to get the best deals.

To this end, there are several key tips that prospective buyers should consider when looking for a home or investment property:

- Monitor Local Market Updates: Keeping tabs on local news and updates can help potential buyers understand current pricing dynamics within different neighborhoods throughout South Florida as well as any new developments that could alter the overall outlook of the area.

- Compare Mortgage Rates: With numerous lenders offering varied terms and conditions attached to their mortgage rates, it’s important for buyers to take time to compare all available options so they can secure good financing at reasonable costs.

- Hire an Experienced Realtor: Having access to experienced professionals who keep up with recent listings in the area can be extremely beneficial for those looking for newly available properties before anyone else does – potentially saving them money down the line.

- Review Previous Transactions: Analyzing previous transactions from similar properties nearby can provide valuable insights into what kind of offers will be accepted by sellers and how much room there may be for negotiating prices. By understanding these underlying factors, purchasers can make informed decisions about whether certain homes are worth investing in based on expected returns.

By taking advantage of these tips, savvy investors can gain insight into how various forces play out in the Miami real estate market, enabling them to find great deals while still making sound investments.

The Rental Market In Miami

As of 2023, the rental market in Miami is expected to remain strong due to various factors. One of the primary factors driving the demand for rental properties is the high cost of homeownership, which has made it difficult for many individuals and families to afford a home. This has resulted in a growing population of renters in the city.

Another factor contributing to the rental market’s strength is the city’s high cost of living. Miami is known for its luxury lifestyle, which attracts many high-income individuals who prefer to rent rather than buy a property.

This trend is expected to continue in 2023, with an increasing number of luxury apartment complexes and rental properties catering to this market.

Moreover, the ongoing COVID-19 pandemic has also contributed to the strong demand for rental properties, as many individuals have hesitated to buy a home amidst economic uncertainty. This has resulted in an influx of renters looking for more flexibility and short-term leases.

As a result of these factors, the rental market in Miami is highly competitive, with rental prices increasing in certain neighborhoods. It is essential for renters to be prepared for the competitive environment and to act quickly when finding a suitable rental property.

Overall, the rental market in Miami is expected to remain strong in 2023, with demand continuing to outweigh supply. Prospective renters should be prepared for the high costs of living and be proactive in their search for rental properties.

Little Haiti Real Estate Market Overview

In recent years, the Miami real estate market has seen a notable slowdown in price appreciation. This is especially true for certain neighborhoods within the city, including Little Haiti.

As such, it warrants an examination of this area’s current rental and sales market conditions to better understand what potential buyers and tenants can expect from this part of town.

Overall, Little Haiti offers renters and investors some compelling opportunities due to its relatively low prices compared to other parts of Miami.

Despite the fact that average asking prices have dropped since last year, there are still many properties available at relatively affordable rates – making them attractive prospects for those on tighter budgets.

In addition, the availability of housing options has grown significantly over the past few months as more sellers enter into the market.

Considering these factors, it could be argued that this neighborhood could see a bump in activity over the coming months if market conditions remain favorable.

Looking forward, much will depend on how quickly inventory levels decrease and whether any new developments will come onto the scene soon.

While no one can forecast with absolute certainty what lies ahead for Little Haiti’s real estate markets in terms of pricing trends or future demand levels, it appears likely that buyers and tenants may find good value here in comparison with other areas around greater Miami-Dade County – particularly if they act sooner rather than later.

Coconut Grove Real Estate Market Overview

In stark contrast to the Little Haiti market, Coconut Grove is one of Miami’s most expensive and exclusive neighborhoods.

Home prices here are among the highest on record in Miami-Dade County and have only continued to rise over the past several years due to its popularity with affluent buyers.

On average, a single-family home in Coconut Grove will cost upwards of $900,000 – making it well out of reach for many potential renters or investors.

That said, those able to afford these premium properties stand to benefit from significant long-term appreciation potential as demand continues to remain high for this area.

It should be noted that real estate prices throughout greater Miami can vary drastically depending on location and other factors such as age and condition of housing stock.

For example, although average asking prices within Coconut Grove hover around $900K at the present time, some homes may still be purchased for significantly less than this figure, depending upon their individual characteristics.

Moreover, certain parts of town may offer better value when compared with others – something worth considering before committing to any major purchase decision.

Overall, while the Coconut Grove real estate market has become known for its luxury offerings and hefty price tags, astute buyers would do well not to overlook existing opportunities, which could represent an attractive return over time if they are willing to invest properly.

Investing Opportunities In The Miami Real Estate Market

Miami is a bustling and vibrant city with an ever-growing real estate market. Home prices in Miami have increased significantly since 2010, making it an attractive option to potential investors looking for long-term capital gains.

The following list details some of the best investment opportunities currently available within the Miami housing market:

1) Investing in newly constructed homes – As new construction continues to be popular amongst buyers seeking modern amenities and updated living spaces, those able to invest early could potentially benefit from significant appreciation over time as demand increases.

2) Buying pre-existing properties at reduced rates – While similar investments can also bring about high returns, existing residential properties that are offered at discounted prices due to age or condition may represent a greater value when compared with brand-new homes.

3) Rentals – Taking advantage of current rental trends can provide both short and long-term income streams depending on one’s investment goals. Longer leases tend to yield higher returns, while shorter terms offer more flexibility but often come with smaller profits in return.

4) Flipping houses – Though sometimes risky, house flipping remains a viable strategy if done correctly; by purchasing low-cost fixer uppers and reselling them after renovations are made, savvy investors can make substantial profits quickly, especially in appreciating markets such as Miami’s.

Given all this information surrounding Miami home prices, Miami real estate homes, and Miami real estate price trends, those interested in investing should take care not to rush into any purchase decisions without first doing their due diligence.

This brings us then to our next topic regarding common mistakes to avoid when buying a house in Miami…

Common Mistakes To Avoid When Buying A House In Miami

When investing in the Miami real estate market, it is important to understand the common mistakes that can be made. Buyers’ first mistake is not properly researching the property and its potential for appreciation or rental income.

It is essential to compare sale prices of similar properties within the area and analyze current trends before making any purchase decisions.

Secondly, novice investors may overlook hidden costs such as closing fees and maintenance expenses associated with owning a home.

Lastly, failing to set realistic expectations when considering long-term investments could lead to disappointment down the line if desired results are not achieved.

It is also advisable for prospective homeowners or tenants to research local taxes and insurance premiums which can add additional costs to one’s budget depending on where they choose to buy or rent in Miami’s expansive residential market.

TIP: Seeking help from qualified professionals like mortgage advisors or real estate agents who specialize in local markets can help you avoid costly missteps when navigating through the world of Miami property market transactions.

Property Taxes And Insurance Costs For Property Owners In Miami

Property taxes and insurance costs are important factors to consider when investing in the Miami real estate market. With home values on the rise, it is critical for buyers to understand what their property will be taxed at accordingly.

On average, a house in Miami can cost anywhere from $300K to over $1 million, depending on location and amenities. As such, these properties are subject to different tax rates that vary by district and neighborhood.

Furthermore, finding affordable home insurance premiums requires research into local providers and comparing coverage options to find the best value for their needs.

Real estate trends in Miami show increasing demand, with prices continuing to climb despite the recent COVID-19 pandemic.

This has made housing more expensive and provided investors with opportunities to capitalize off rising values if they have sufficient capital or access to financing options like mortgages or loans.

Rental income is another avenue where profits may be generated due to a high population density within certain areas of the city which could lead to higher yields than other markets outside of Florida’s largest metropolis.

In light of this information, potential homeowners must weigh all factors before making any big investments into Miami’s competitive housing market—especially those who are looking for long-term returns through appreciation or rental income streams.

Impact Of Covid-19 On The Housing Market Of Miami

The Covid-19 pandemic has significantly impacted the Miami real estate market. While home prices in Miami were previously increasing at an average of 6% per year, the onset of the pandemic saw house values dip by 2%.

This was due to decreased demand from buyers and sellers and increased uncertainty surrounding the virus’s effects on employment, businesses, and the overall economy.

However, since then, there have been signs of recovery for the Miami fl, real estate market with a slight uptick in a median sale price that is now hovering around $370K—1% higher than it was pre-COVID.

Additionally, even though inventory levels remain low compared to 2019 levels, new listings are up 17%, suggesting more potential for buyers who want to take advantage of current conditions.

Overall, while there may be some short-term volatility due to external factors like unemployment numbers or vaccine distribution efforts, the long-term outlook for Miami’s housing market remains positive, given its status as one of America’s most desirable cities to live in and invest in.

These trends should be taken into consideration when forecasting future trends in the housing market in Miami.

Forecasting Future Trends Of The Housing Market In Miami

As the Miami real estate market continues to rebound from the effects of Covid-19, it is important to consider what trends may be in store for the future.

Analyzing current data and making informed assumptions can help investors decide whether investing in Miami’s housing market is a wise option.

When looking at average house prices throughout Miami, it appears that the condo market has been particularly resilient during this period of uncertainty. The median sales price for condos rose 2% year-over-year despite the overall decrease in home values due to Covid-19.

This suggests that buyers may be more willing to invest in luxury condominiums than other types of dwellings as they are viewed as safer investments with the potential for high returns on investment.

Furthermore, there have been some indications that job growth could return soon, which would also likely lead to an uptick in demand for Miami homes and condos.

Factors such as low mortgage interest rates and increased confidence in the local economy could provide additional incentives for buyers who are searching for new opportunities amidst today’s uncertain economic climate.

In sum, while external factors like pandemic restrictions will continue to shape short-term fluctuations within Miami fl, real estate market, long-term predictions suggest that there is significant potential for continued growth given its status as one of America’s most desirable cities to live in and invest in.

As such, now may be a great time to start researching available properties if you’re interested in taking advantage of these conditions before others do so.

Frequently Asked Questions

How Much Does A Mortgage Cost In Miami?

Mortgages are a common form of financing for real estate investments. They generally require the borrower to make monthly payments, including principal and interest, with a set repayment period.

The cost of a mortgage in Miami will depend on several factors, including the type of loan and the creditworthiness of the borrower.

The most popular types of mortgages available in Miami are fixed-rate loans and adjustable-rate mortgages (ARMs). Fixed-rate loans offer borrowers the security of knowing their interest rate won’t change over time.

ARMs usually start out with lower rates than fixed-rate mortgages but can increase after an initial period. Depending on the terms of the ARM, this could mean higher monthly payments down the road.

In addition to loan type, lenders consider other factors when deciding whether to approve a mortgage application or not, such as income level, credit score, debt-to-income ratio, and any existing assets.

These criteria help determine what kind of loan you qualify for and at what interest rate. Ultimately, these decisions will affect how much your mortgage costs in total over its life span.

TIP: Before applying for a mortgage in Miami, it’s important to research different options and understand all associated fees so that you can find one that is affordable and fits your needs.

What Are The Best Neighborhoods For First-Time Homebuyers In Miami?

Miami the vibrant jewel of South Florida has been attracting newcomers for decades with its sunny climate and exciting cultural heritage. Home to many diverse neighborhoods offering various lifestyles, it is no wonder why Miami remains an attractive real estate market.

When looking at purchasing property in Miami, there are several factors to consider when choosing one’s ideal neighborhood, such as cost of living, availability of amenities, proximity to schools and business centers, etc.

A few popular areas include Little Haiti & Buena Vista, Wynwood & Edgewater, Coconut Grove, and Coral Gables. Each area features different benefits that can appeal to those looking for their first home purchase in Miami.

Little Haiti & Buena Vista feature affordable homes situated close to downtown Miami and Biscayne Bay with easy access to entertainment venues like The Citadel and Magic City Innovation Districts.

This location also offers plenty of restaurants and shops as well as pleasant outdoor spaces like Margaret Pace Park and Legion Park.

Meanwhile, Wynwood & Edgewater provide quick access to beaches while still being located near major employment hubs like Downtown Miami and Brickell Financial Center.

Additionally, this area provides walkability through its colorful street art galleries and murals, as well as trendy boutiques.

For those seeking more traditional properties within reachable distance from the city center, then, Coconut Grove may be just right – providing nearby parks along with shopping plazas full of retail stores, cafes, and bistros plus convenience to local schools or universities such as the University of Miami.

Lastly, there is Coral Gable’s -a planned community known for its Mediterranean Revival architecture featuring golf courses, and wide sidewalks perfect for strolling around town or enjoying the outdoors at places such as Matheson Hammock Park or Fairchild Tropical Botanic Garden.

No matter what preference prospective buyers have in terms of budget or desired lifestyle, all these locations prove themselves excellent options for any first-time homeowner in search of a dream house in beautiful Miami.

What Is The Average Interest Rate On A Mortgage In Miami?

Purchasing a home is one of the most significant financial commitments people will make in their lives, and those considering doing so in Miami should be aware of current mortgage rates.

The average interest rate on mortgages for homes purchased in Miami can vary depending upon several factors, including credit score, loan type, and repayment period length. Generally speaking.

However, the following points are important to note:

1) the national average 15-year fixed refinance interest rate is 6.19% as of March 1, 2023, which is down compared to last week’s rate of 6.20%.

2) According to a forecast by mortgage giant Fannie Mae, the 30-year mortgage rate is expected to range between 6.6% and 6.2% throughout 2023, with an average annualized rate of 6.4%

3) Adjustable Rate Mortgages (ARMs) tend to start with lower initial rates but may go up over time;

4) Mortgage lenders often offer discounts such as discount points which reduce the overall cost of borrowing by reducing the principal balance or interest rate.

In order to maximize savings when purchasing a home in Miami, it’s wise to shop around for different types of loans and compare fees associated with each option available. Additionally, buyers should pay attention to additional costs that could increase their monthly payments beyond the interest rate.

These costs include closing fees, taxes, and insurance premiums, which differ based on location and property size.

Furthermore, prospective homeowners must consider whether they plan to live in the home for an extended period of time before securing a mortgage because if not, then obtaining an ARM might be more beneficial financially rather than opting for a longer term fixed rate loan.

At present, there are many options available when it comes to finding competitive mortgage rates in Miami due to both technological advances that allow people to obtain quotes online quickly and easily, as well as increased competition between lenders vying for business.

Therefore potential borrowers should take advantage of this situation by researching various lenders who specialize in offering competitively priced loans suited specifically for them and their individual needs before committing to purchase a new home.

What Are The Current Zoning Regulations In Miami?

With the hustle and bustle of city life, understanding zoning regulations can be daunting for newcomers and long-time residents. Whether you are looking to rent or purchase property in Miami, it is important to know what rights and limitations you will face with regard to city ordinances.

This article focuses on the current zoning regulations within the city limits of Miami, providing critical information for those considering relocation or investment opportunities.

When referring to zoning laws, there are primarily two types; residential and commercial. Residential zones refer to areas where single-family dwellings and multi-family buildings such as townhomes or apartments may exist.

Commercial districts refer to any land use that produces income through business transactions, like retail stores and restaurants.

Both types have their own set of rules which must be followed at all times when constructing new structures or making alterations to existing ones.

The City of Miami has designated certain sections of its urban area as “zoned” regions, giving each district unique characteristics based upon the properties within them.

Zoning ordinances dictate how much lot size an individual residence requires, whether buildings should feature gates or fences around them, and if parking spaces need to be provided for visitors.

Additionally, design guidelines specify specific colors for exterior paint jobs, whereas sign restrictions limit signage placement throughout neighborhoods.

Knowing these details can help streamline construction projects while avoiding costly fines for noncompliance with local codes.

There is no one answer when assessing the effect that zoning regulations have on real estate investments in Miami – this depends entirely on the type of project being undertaken by investors and developers alike.

However, obtaining professional insight into the legalities surrounding development plans is paramount before moving forward so as not to incur financial losses further down the line due to unforeseen issues arising from a lack of knowledge regarding local statutes in place concerning building permits and other related matters pertaining to ownership rights in urban environments.

Are There Any Tax Incentives Or Benefits For Buying A Home In Miami?

Are there any tax incentives or benefits for buying a home in Miami? This question is pertinent to potential homeowners who are considering purchasing real estate within the city.

To answer this inquiry, it helps to look at the current federal and state regulations that have been enacted in Florida.

The Federal government offers several initiatives such as mortgage interest deductions, energy-efficient credits, and Mortgage Credit Certificates (MCCs).

The State of Florida also has its own unique incentives. These include:

• Homestead Exemption which reduces property taxes for those with permanent residency. • Property Tax Deferral Program which allows seniors to defer part of their annual property taxes.

• Land Conservation Incentives, which provide funding for land conservation projects.

• Capital Investment Tax Credit incentivizes investors to purchase residential rental properties and rehabilitate them.

• Low-Income Housing Tax Credits assist developers in building affordable housing units.

In addition, various municipalities throughout Miami offer additional financial assistance programs depending on the specific zip code where prospective buyers are looking to buy a home.

For example, some cities may have down payment assistance funds available or special loan terms specifically designed for first-time homebuyers. Even more appealing is that many local banks will give generous discounts if borrowers meet certain income requirements.

All these options can be quite advantageous when seeking to invest in Miami’s vibrant real estate market.

Purchasing a home in Miami not only presents enticing opportunities due to the vast selection of housing choices from single-family homes, condos/townhomes, and multi-family dwellings but also because of the aforementioned tax incentivizes and other cost savings perks available throughout all levels of government.

Taking advantage of these benefits can make ownership much more accessible than most people initially think possible, thus making investing in one’s future far less daunting than imagined.

Conclusion

The Miami housing market is a dynamic and vibrant one. It offers many opportunities to potential buyers, including attractive mortgage rates and tax incentives that can help make owning a home in the city more affordable.

Additionally, numerous neighborhoods have properties at different price points for first-time homebuyers.

One example of this growth in the Miami housing market is seen through the development of a new luxury condominium building located near downtown. The project includes an array of amenities, such as a fitness center, pool deck, and 24-hour security services.

This property has helped revitalize the area by providing high-quality living spaces to residents looking for modern urban lifestyle options close to employment centers or schools.

Overall, it seems clear that those interested in buying real estate in Miami have plenty of options for finding the ideal neighborhood, securing financing, and taking advantage of government programs designed to promote homeownership throughout the region.

As such, prospective buyers should consider researching these topics further before deciding to purchase property in South Florida’s largest city.